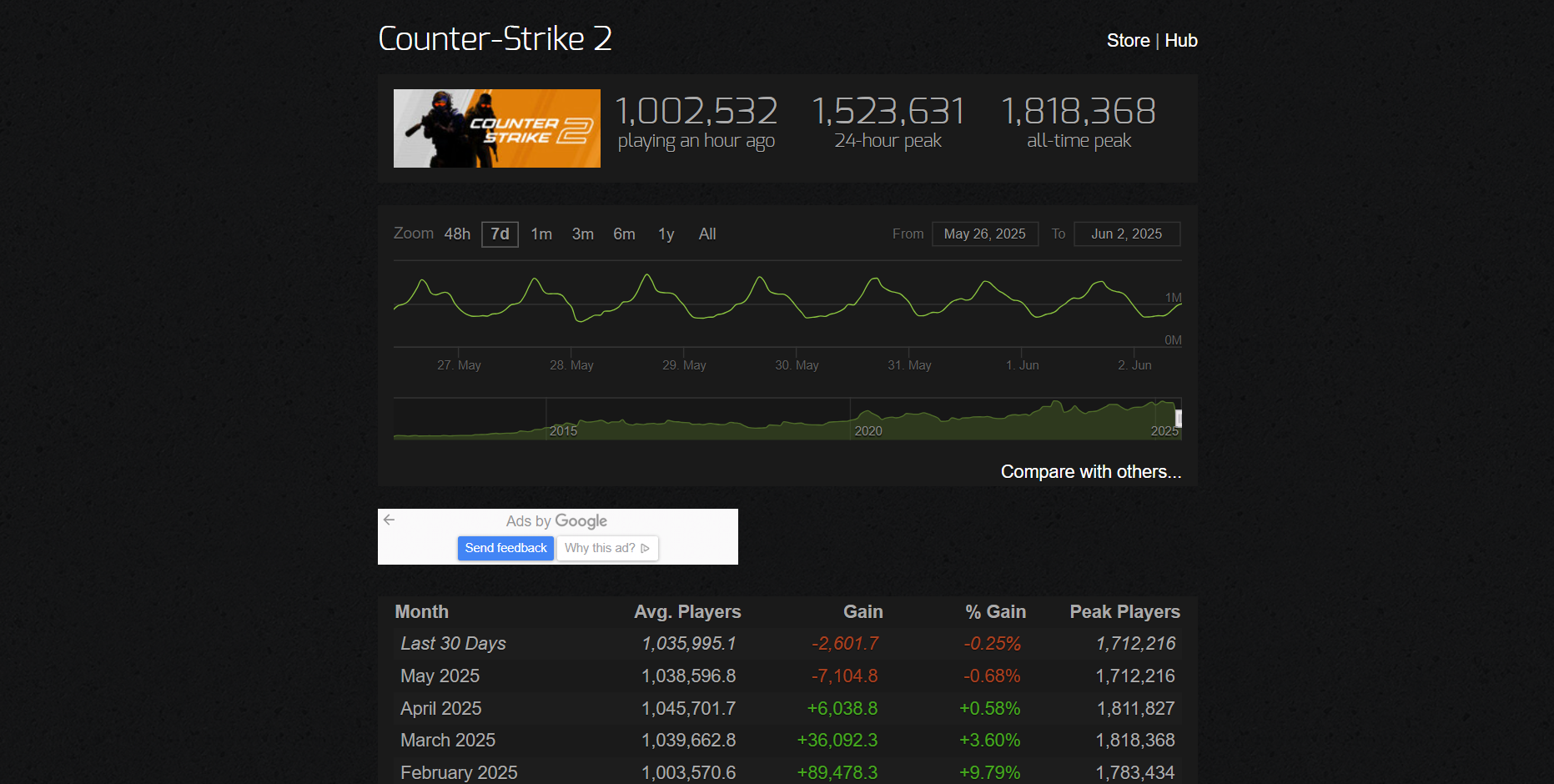

According to Steam Charts, CS2’s peak concurrent players dropped from 1.811 million in April to 1.712 million in May – a 5.5% decline. The average player count decreased by 0.68%. This isn’t a seasonal lull; it happened between IEM Dallas, the Spring Forward update, and just before BLAST Austin Major – all typically high-engagement windows. The game had content, visibility, and momentum. The drop happened anyway.

Structural Breakdown of the Problem

| Category | Cause | Effect |

|---|---|---|

| Game design | Lack of reward systems | Casuals don’t return regularly – no goal to chase |

| Onboarding | Premier is complex for new players | MM is toxic; no easy way in for beginners |

| Updates | Low gamification | New maps exist, but there’s no reason to grind them |

| Scene visibility | Overload of Tier-2 matches | No clarity for viewers – too many matches, no narrative |

| Meta changes | Too frequent to stabilize | Hard to follow, harder to invest into |

How This Impacts the Betting Ecosystem

1. Casual traffic loss = lower first-bet conversion

- Fewer new users = fewer blind brand bets (e.g., FaZe, NAVI)

- Live betting activity on Tier-2 matches dropped ~15%

- First-time deposits declining across skin-integrated sportsbooks

2. Trading and Case Gambling Drop

- Marketplace activity down 11% across Buff, Skinport, CS.Money

- Peak-hour roulette/gambling sessions dropping

- New skins have low volatility – fewer flips, lower resale value

3. A More Analytical Bettor Base Remains

- Hardcore bettors are still here – but want deeper data

- Match preview content is outperformed by map-pool breakdowns, role stats

- Live modelers shift from “winner” to “economy chains” and side-read models

Data-Backed Signals

- Google Trends: “cs2 matches today” & “cs2 live odds” both down ~21%

- Tier-2 match odds refresh rate dropped 8% across major books

- Skin market trading volume down 9.3% (Buff163, CSDeals)

- Prop bet usage (kills, assists, clutches) down significantly in non-majors

Strategic Implications

| Change | Strategic Response |

|---|---|

| Decline in casual traffic | Target core userbase with analytical long-form content |

| Drop in random betting | Shift to map- and economy-based angles |

| Weaker skin trading patterns | Publish market analysis ahead of case releases |

| Loss of Tier-2 viewer engagement | Highlight undercovered matches with storylines, not names |

Conclusion

Player count is dropping. That’s not the end of CS2 – it’s a reset. The ones chasing the hype wave are gone. The ones who analyze, play, and bet with intention remain.

For platforms, content teams, and traders, this is a moment to double down on precision – because when the game swings back up, those who built depth will be the first to convert traffic into value.

|

Mary S Colbert is a Chief Content Editor at csgobettings.gg, specializing in CS2 with over 8 years of experience as an e-sports analyst. Her informative articles on the game have made her a go-to resource for fans and her expertise is widely respected within the industry.

|